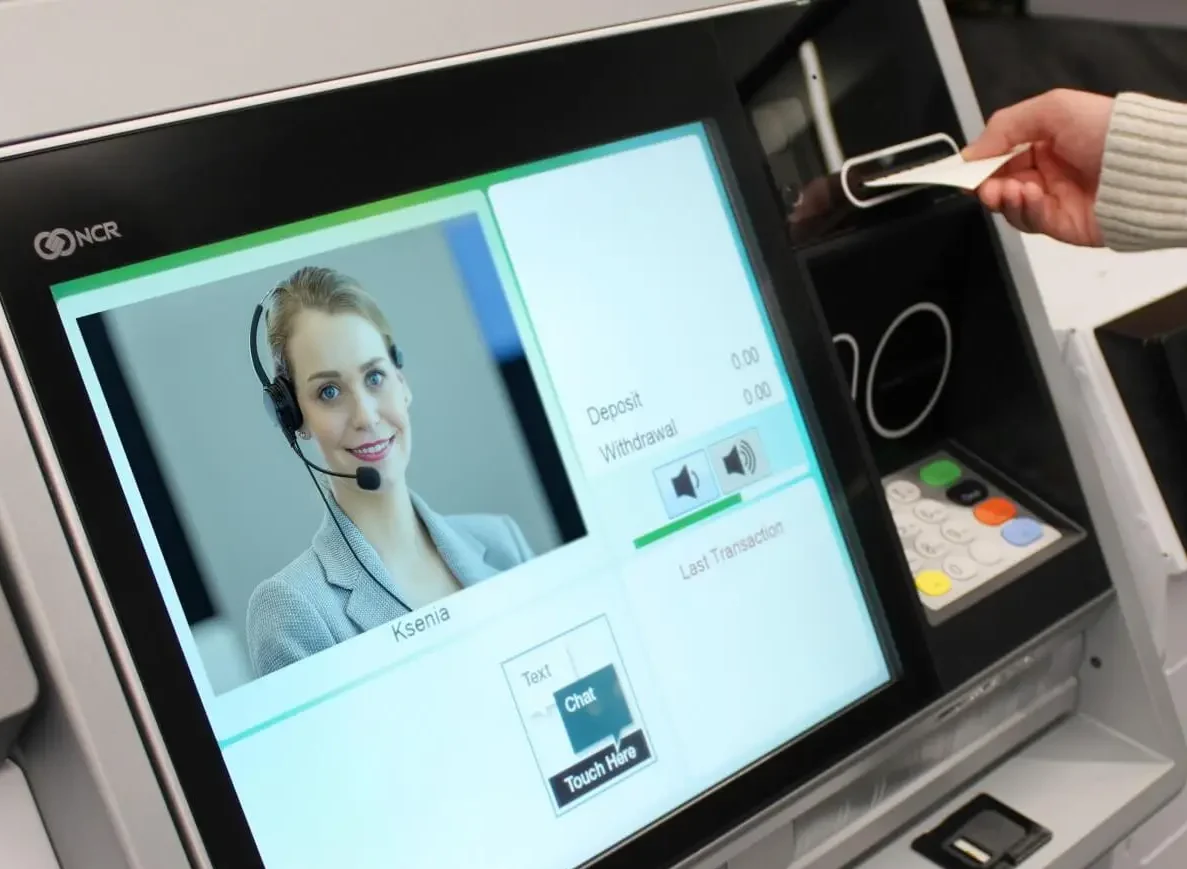

What is Interactive Teller?

Interactive teller machines (ITMs), also known as video remote tellers, are devices with functionality similar to ATMs. The added convenience of speaking directly to a service representative (teller) via a video screen increases the types of transactions that may be done remotely.

ITMs provide an expanded distribution channel, delivering a ‘branch in a box’ experience. They can function as standalone branches that expand service into previously underserved or unavailable markets.

ITMs are capable of performing all of the basic cash transactions of an ATM with the added benefit of personalized banking interactions via a live remote teller.

Less interested in video?

ITMs can connect directly to core banking.

What does an ITM do?

Interactive Teller allows customers to choose either self-service at the ITM or to interact with a centrally located teller in a highly personalized video/audio experience. The teller remotely drives the ATM modules, providing teller service wherever and whenever you wish to offer it to your customers.

This technology gives consumers enhanced accessibility and convenience, allowing them to speak with a teller as though they were face to face in their branch. If they need assistance at any time, the teller can guide them. ITMs perform a wide array of transaction types including, but not limited to:

- Get cash

- Deposit checks

- Cash checks

- Perform card-less transactions

- Bill and loan payments

- New account opening and funding

- Transfer funds to any account

- Order replacement cards

- Process savings bonds and redemptions

- Process CD renewals and inquiries

- Issue bank checks or money orders

- Investment account transactions

- Access to all accounts

- Credit card payments

What’s the difference between an ATM and an ITM?

Automated Teller Machine (ATM)

- Excellent for basic self-service transactions that don’t require a teller

- Credit or debit card used to access cash

- Cash-dispensing (typically large bills)

- Check depositing

- Account information access

- Fund transfers

- Marketing of relevant products

- Proven, dependable, cost-effective

Interactive Teller Machine (ITM)

- All the features and functionality of an ATM

- Can also handle complex and higher-value transactions that require a bank representative or teller

- Video camera or telephone for real-time communication with a teller

- Multi-denomination dispensers for cash and coins (including small bills)

- ID scanner and signature pad

- Innovation that can give financial institutions a competitive advantage

- Provides both convenience plus human interaction for consumers

Configured to meet your needs.

As NCR’s largest financial partner in the U.S., QSI installs and services more ITMs than any other company. Internal or external, walk-up or drive-up, QSI can configure an ITM to suit your financial institution’s needs and accomplish your specific self-service objectives – from extending hours to updating old pneumatic equipment with the latest in technology – and so much more….

- Build stronger customer/member relationships

- Increase teller efficiency

- Improve branch organization

- Extend service hours

- Expand geographic reach

- Offer more locations

- Serve rural/remote areas

- Increase marketing opportunities

- Manage risk

- Reduce costs

If you are exploring ways to do more with less, let us show you how Interactive Teller works.

Struggling with staffing challenges? One teller operating an ITM can typically handle the workload of three tellers.

“ITMs can function as standalone branches, capable of expanding a financial institution’s ability to serve people and places it could not reach before.”

“ITMs allow us to do more with less – without eliminating a single job.“

Case Study: Using ITMs to Solve Complex Acquisition Challenges

How does an established bank utilize technology to serve the needs of rural and urban customers while welcoming employees from multiple acquisitions?

Read how Interactive Tellers helped a growing community bank provide access for all.

Get ITM technology with less upfront cost.

QSI offers an all-inclusive outsourcing and managed services program called QSI At Your Service (AYS). From installation and roll out to ongoing maintenance and cash management, we take care of everything, freeing you to focus on what matters most?serving your customers/members. It’s self-service, simplified.

Interactive Teller is a secure, leading-edge, high-performing way to attract and retain customers, improving your ability to compete in today?s dynamic marketplace, and QSI At Your Service offers this technology at a lower upfront cost.

Maximize your ITM investment.

Core Integration For Enhanced Self Service

Core banking access enables a broader range of services for consumers, allowing them to see and do more via self-service. It provides greater flexibility while utilizing the same security. And delivering a broader set of services to your consumers at your ATMs encourages loyalty. Move your ATMs beyond cash automation to a full range of banking services. Visit our ESS page to learn more.

Enhanced Branding and Signage

Make your investment stand out while making it easy for customers / members to find and use. Enhanced branding and signage with custom fabrication of canopies, kiosks, surrounds is available with our in-house design and fabrication department, CapStone Design & Fabrication.

What can interactive teller do for you?

- Extend service hours

- Offer more locations

- Serve rural/remote areas

- Improve branch organization

- Increase teller efficiency

- Build stronger relationships