Enhanced Self-Service (Core Integration)

People often have more than one financial product with their financial institution. In addition to traditional checking or savings accounts, there may be shared accounts, loans, mortgages and more. Consumers want to access these accounts in the same way they do from digital banking apps, through self-service. Providing that access in order to reduce the cost to serve and improve consumer experience is exactly what Enhanced Self-Service delivers!

Bank staff can focus on advising customers and resolving complex needs rather than routine banking transactions.

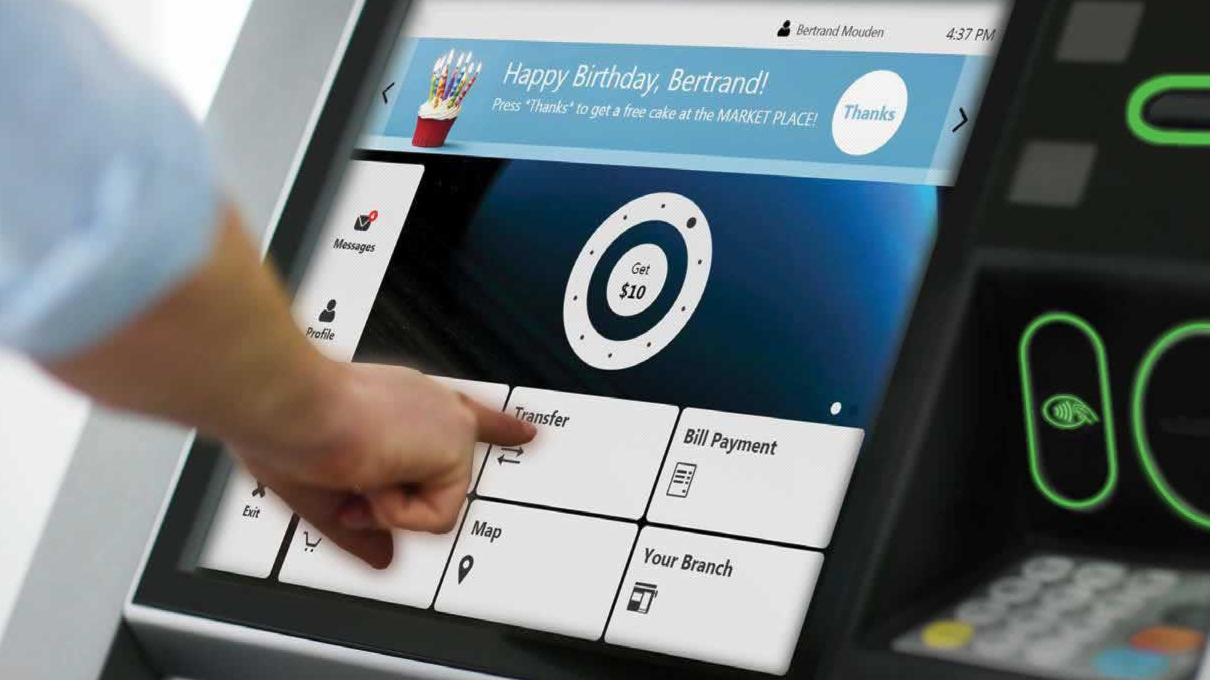

Enhanced Self-Service (ESS) at the ATM and ITM delivers more transactions for all accounts in a self-service mode. Consumers can do more independently 24/7 such as loan or credit card payments and account to account transfers. Most transaction types and volumes can be addressed with ESS. Bank staff can now focus on advising and resolving consumers’ complex needs rather than routine banking transactions.

Transactions that historically required a teller can now be fully automated and performed via self-service directly at the machine.

Connect Directly to Core Banking

Core banking access enables a broader range of services for “on-us” consumers, allowing them to see more and do more via self-service. It provides greater flexibility than using the conventional ATM rails while utilizing the same security. Plus, standard transactions are still available for “off-us” consumers through the usual ATM environment. Activate Enterprise NextGen fully supports ESS and core banking connection. This moves the ATM beyond cash automation to becoming a secure access point for a full range of banking services.

Build Loyalty While Reducing Your Cost to Serve

Delivering a broader set of services to your consumers at your own ATMs encourages loyalty. Consumers are less likely to use alternative ATMs when they know better services are available from their own financial institution. And as an ATM deployer, you can deliver those services without the transaction processing and switch fees of the conventional ATM channel.

Core banking access enables customers to see more and do more via self-service, while lowering your cost to serve.

For the consumer, benefits, include a 360 degree view and self-service access to all connected accounts, putting them in control of how they view, access and interact.

Allow Customers to See More and Do More

- Access to all core-connected accounts

- Account balance for all core-connected accounts

- Mini statement

- Cash withdrawal

- Cash and check deposit or transfer into core connected accounts

- Includes loan and credit card accounts

- Account to account transfers

- Loan and credit card payments

- Transaction chaining

- Check cashing and standard check hold

- NDC preferences

- Connect to additional enterprise and digital banking services

And for the financial institution, Enhanced Self-Service has these benefits as well:

- Ability to build out new and customized core transactions

- Simplified balancing and reconciliation

- Avoid switch fees for on-us customers

Move beyond cash automation to provide a full range of secure core banking services.

Integrate NCR hardware directly with your core to provide additional product offerings, eliminate overhead, and reduce staffing requirements.

Our team will work with you to customize and refine the transaction flow from beginning to end to fulfill your financial organization’s unique business requirements.

What can Enhanced Self-Service do for you?

- Allow customers to see and do more via self-service

- Provide greater flexibility without compromising security

- Encourage customer loyalty with a wider range of services