In today’s fast-paced world, convenience reigns supreme, and nowhere is this more evident than in the realm of banking. Increasingly, consumers are seeking self-service options that allow them to access their finances on their terms, at their convenience. This shift in consumer behavior is driven by a myriad of factors, from the desire for autonomy and control to the need for efficiency and flexibility.

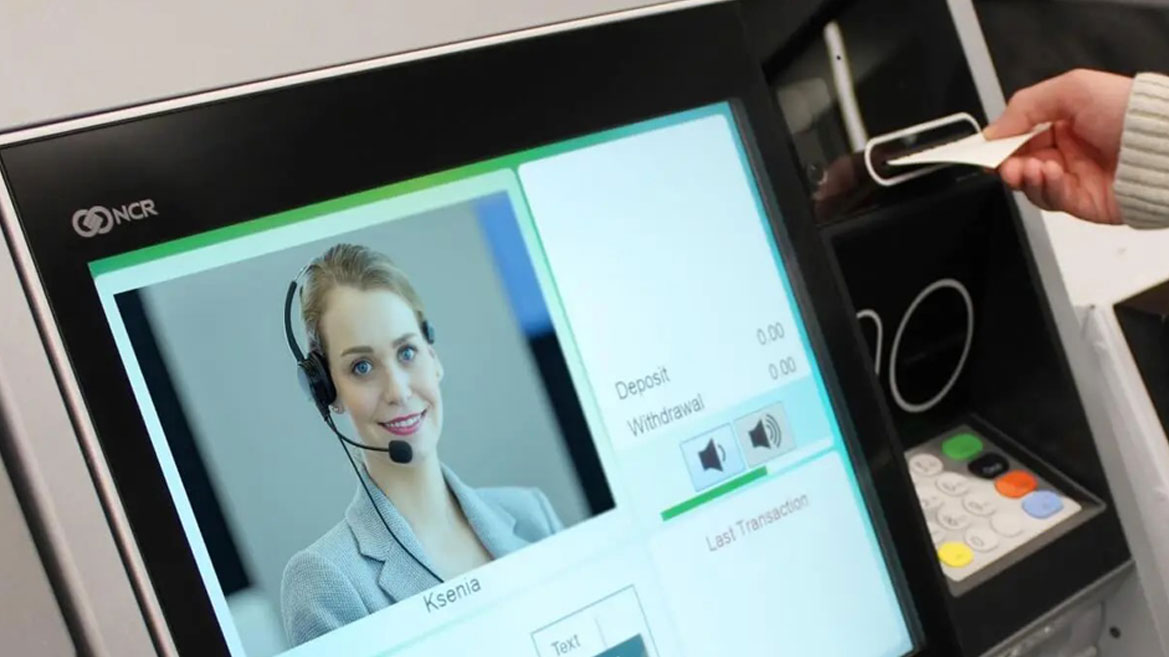

At the heart of the self-service banking trend is the consumer’s quest for convenience. Whether it’s checking account balances, depositing checks, or withdrawing cash, consumers want the ability to conduct their banking transactions seamlessly, without being bound by the constraints of traditional banking hours or branch locations. Self-service channels such as ATMs (Automated Teller Machines) and ITMs (Interactive Teller Machines) offer consumers the freedom to manage their finances anytime, anywhere, empowering them to take control of their financial lives on their own terms.

For younger consumers, the appeal of self-service banking goes beyond mere convenience. Growing up in a hyper-digital age, younger generations are accustomed to having information and services at their fingertips, thanks to the proliferation of smartphones and digital technology. As such, they have come to expect the same level of convenience and accessibility from their banking experiences.

Self-service banking channels resonate with younger consumers because they align with their preference for digital-first solutions and their desire for instant gratification. ATMs and ITMs provide a user-friendly interface and quick, efficient transactions, allowing younger consumers to complete their banking tasks with minimal hassle. Whether it’s withdrawing cash on the go or depositing a check outside of traditional banking hours, self-service options cater to the fast-paced lifestyles of younger consumers, enabling them to bank on their own terms, without sacrificing convenience or efficiency.

Moreover, self-service banking channels offer younger consumers a sense of empowerment and autonomy over their financial decisions. By providing convenient access to essential banking services outside of traditional branch settings, ATMs and ITMs empower younger consumers to take charge of their finances independently, fostering a greater sense of financial responsibility and control.

The growing demand for self-service banking reflects consumers’ desire for convenience, accessibility, and autonomy in managing their finances. For younger consumers, in particular, self-service channels like ATMs and ITMs offer a seamless and efficient banking experience that aligns with their digital-native preferences and fast-paced lifestyles. As banks and credit unions continue to invest in self-service technology, they can better cater to the evolving needs and expectations of their customer base, enhancing customer satisfaction and loyalty in an increasingly competitive landscape.